Sales Next Level

IN FOCUS

Sales Next Level: The 5 Biggest Challenges

And how to solve them

- Resources

- Publications

- The 5 Biggest Challenges

Executive Summary

The 5 biggest challenges for automotive supplier sales:

1. Too few, too many or the wrong orders

2. Loss-making orders

3. Risk excel price management

4. No time

5. Success is not visible

The solution: The key challenges for automotive supplier sales can be successfully met with digitization. The Digital Automotive industry standard has been developed on the basis of these challenges and creates solutions that help automotive suppliers achieve profitable growth and increase employee satisfaction.

INTRO

What really Matters?

In automotive supplier sales, there are 5 key challenges that are essential to the success of the company and the satisfaction of the individual employee

Hundreds of conversations with sales employees and managers, analyses, projects and personal experiences lead to 5 challenges for the automotive supplier sales.

From the company's perspective, the focus is of course on profitable growth. Sales makes a significant contribution to this by bringing the right orders into the company and ensuring profit increases through change & claim management. It is no less important to be aware of the risks you carry around with you when you try to manage prices with Excel.

"The challenges for automotive supplier sales have not changed in the past 25 years. But the possible solutions have!"

Erik Reiter

25 years Automotive Supplier-Management (Sales -> CEO); Sales Consultant for Strategy and Processes; Co-Founder Digital Automotive

In addition to the company's perspective, there is also that of the employees who have no time because they are overwhelmed with tasks on ad hoc reports and have to cope with unsatisfactory processes. Or the top performers who would like to have his performance rewarded so that they are motivated to continue to deliver top performance for the automotive supplier also in the future.

These challenges will be examined in more detail below and the corresponding possible solutions will be shown. Digitization has given us completely new possibilities to do this.

CHALLENGE 1

Too few, too many or the wrong Orders

The most important task of sales is to generate new orders. Everyone would probably answer this in the same way even if they didn't work in sales. But the crucial question is which orders and how many, in which regions, in which plants, with which products, with which customers make sense?

The point is to get not just any orders, but the right orders. If too few, too many or the wrong orders are won, there will be consequences, which are outlined below:

The consequence

Each of these 3 conditions has consequences that are easy to recognize and understand:

Too few orders lead to underutilization in the plants, in the project teams and to insufficient contribution margins for the overheads. The negative impact on profitability is clear to everyone.

Too many orders is not much better. Suppliers with too few resources to professionally process orders create dissatisfied customers, overworked employees and can quickly find themselves in financing problems.

Orders that do not correspond to a strategy defined according to market or resource criteria are counterproductive and are therefore the wrong orders for the company.

Automotive suppliers operating in this highly competitive market cannot afford any of the above conditions.

How do we get too many, too few or the wrong orders?

Many automotive suppliers lack processes or mechanisms to operationalize strategy and verify implementation. 5 key problem areas exist in this regard:

(1) Lack of market analysis

A strategy definition that is disconnected from market developments cannot be successful. Both the strategy definition and the operationalization must be linked to concrete market data in order not to operate in illusory worlds.

(2) Lack of operationalization

Missing operationalization or operationalization that is not aligned with the strategy is a widespread problem. Concrete target projects, with which products one would like to get into which cars or engines, are often missing or do not fit the strategy. As a result, the acquisition process is thus not guided by strategy, but driven by opportunity.

(3) No regular review and adjustment

Sales planning often gets lost in infinitely complex Excel files with inadequate evaluation options to identify undesirable developments. A continuous review and adjustment possibility of the strategy with changing conditions is missing. Instead, the planning process is limited to once-a-year meetings. Fatal in a dynamic world such as we are currently experiencing.

(4) Lack of focus

No or too little focus on the agreed (operationalized) strategy prevents the implementation of the planned alignment. In order for the target projects to be successfully won, a focus of all functions on these projects is necessary.

(5) Intransparent acquisition process

An intransparent acquisition process that is not synchronized with the strategy leads to orders that are opportunity-driven and not guided by a strategy.

What can an automotive supplier do to win the right orders?

Clearly structured processes that address each of the above problem points. Consistency, depth of detail, transparency, KPI's and real-time information are the success parameters. These are needed from the market observation to the strategy to the concrete acquisition project.

Management-ready reports that enable continuous success monitoring keep the company on track.

The issue has complexity, of course, but that's what digitization was invented for. Each of the problems mentioned can be eliminated via an automotive supplier-specific software solution. Whoever relies on the right solution here has the best prerequisites for winning the right orders in the future.

What does digitization look like in strategic sales planning and implementation? The following examples serve to illustrate the idea:

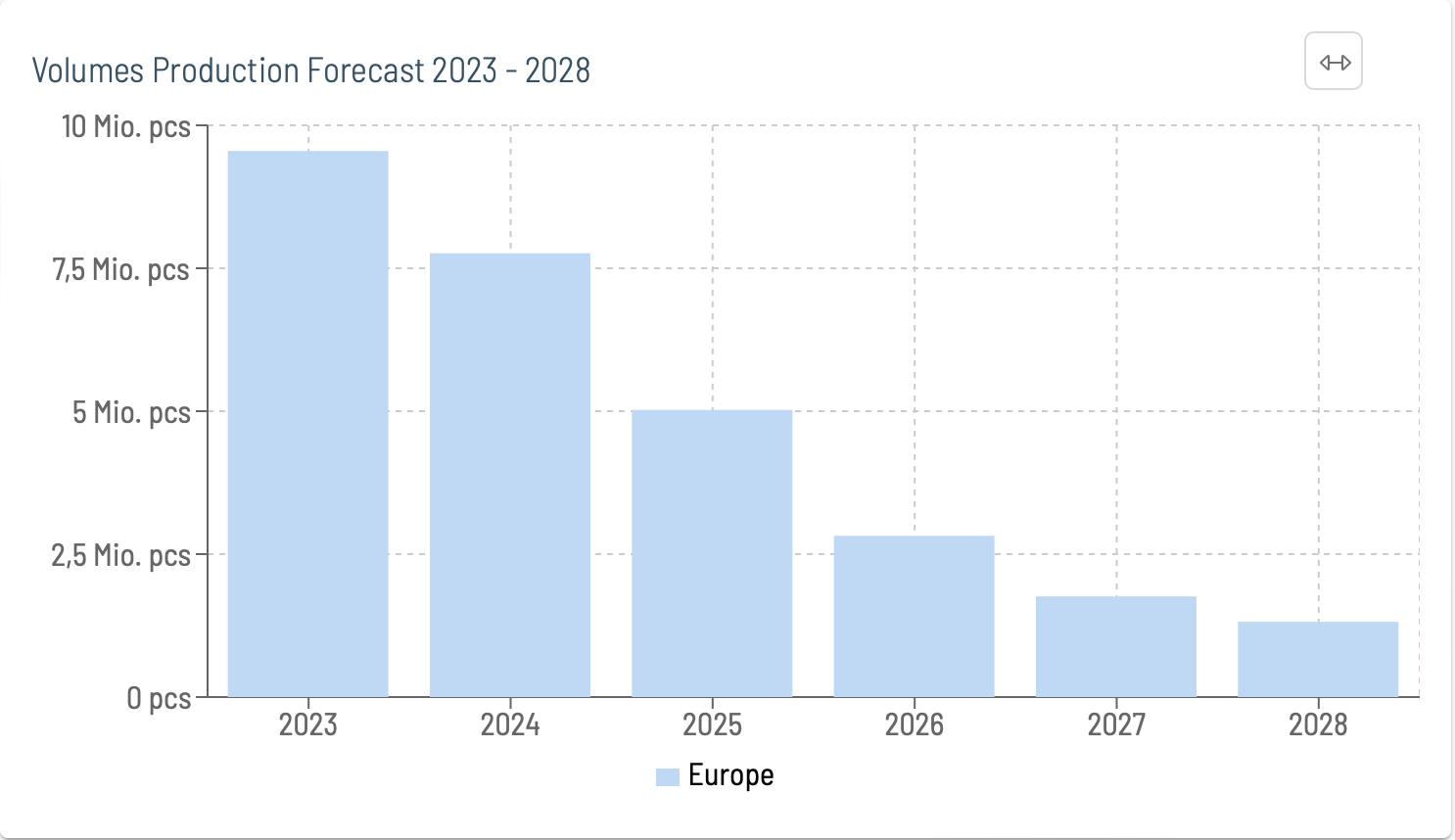

1 MARKET ANALYSIS:

Example: Development of unit sales of combustion engines in Europe

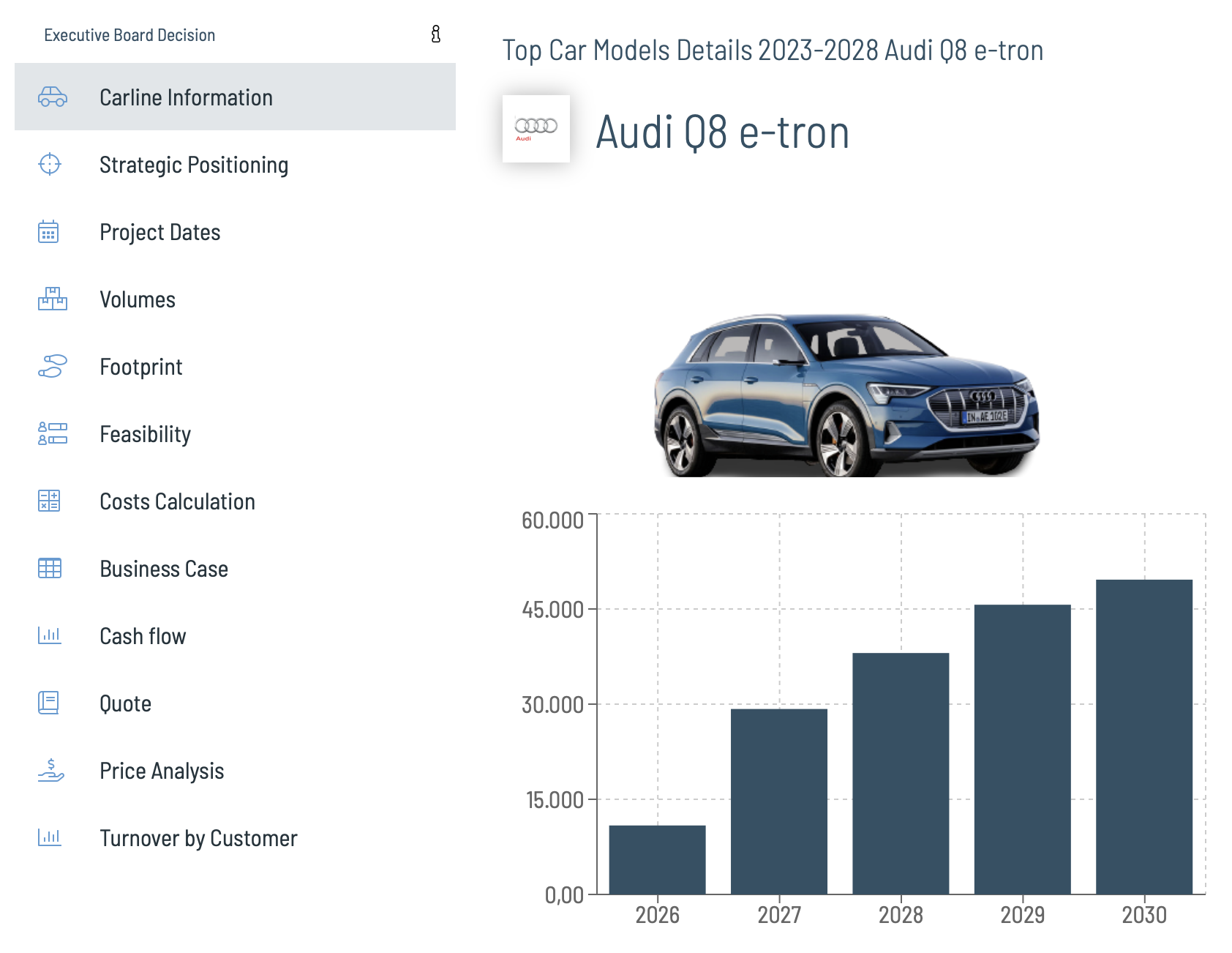

2 STRATEGIC TARGETS:

Identification of the vehicles or engines in which the company's own products are to be installed

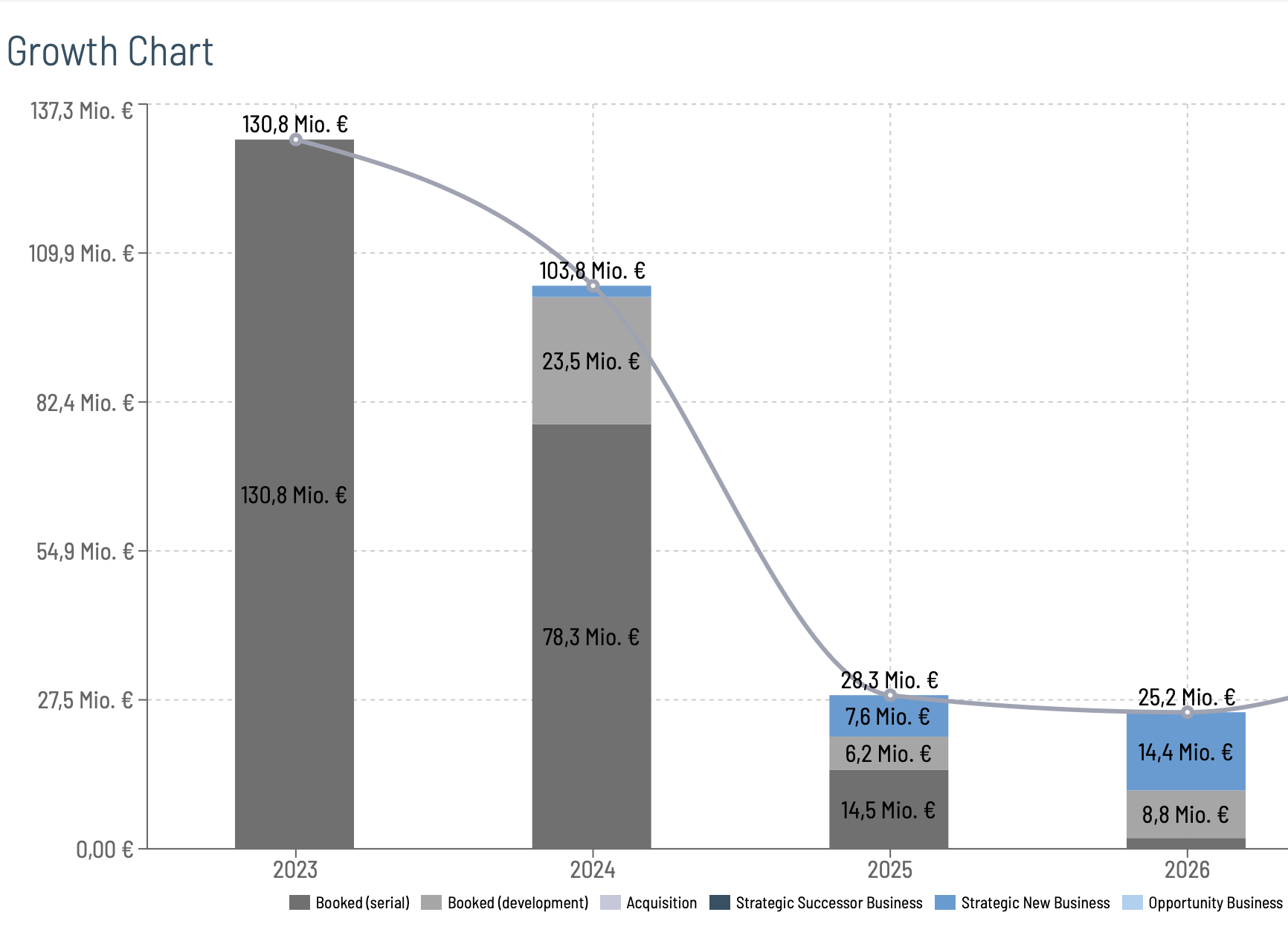

3 REVIEW OF THE GROWTH

Are the planned projects and the associated sales in line with the strategy?

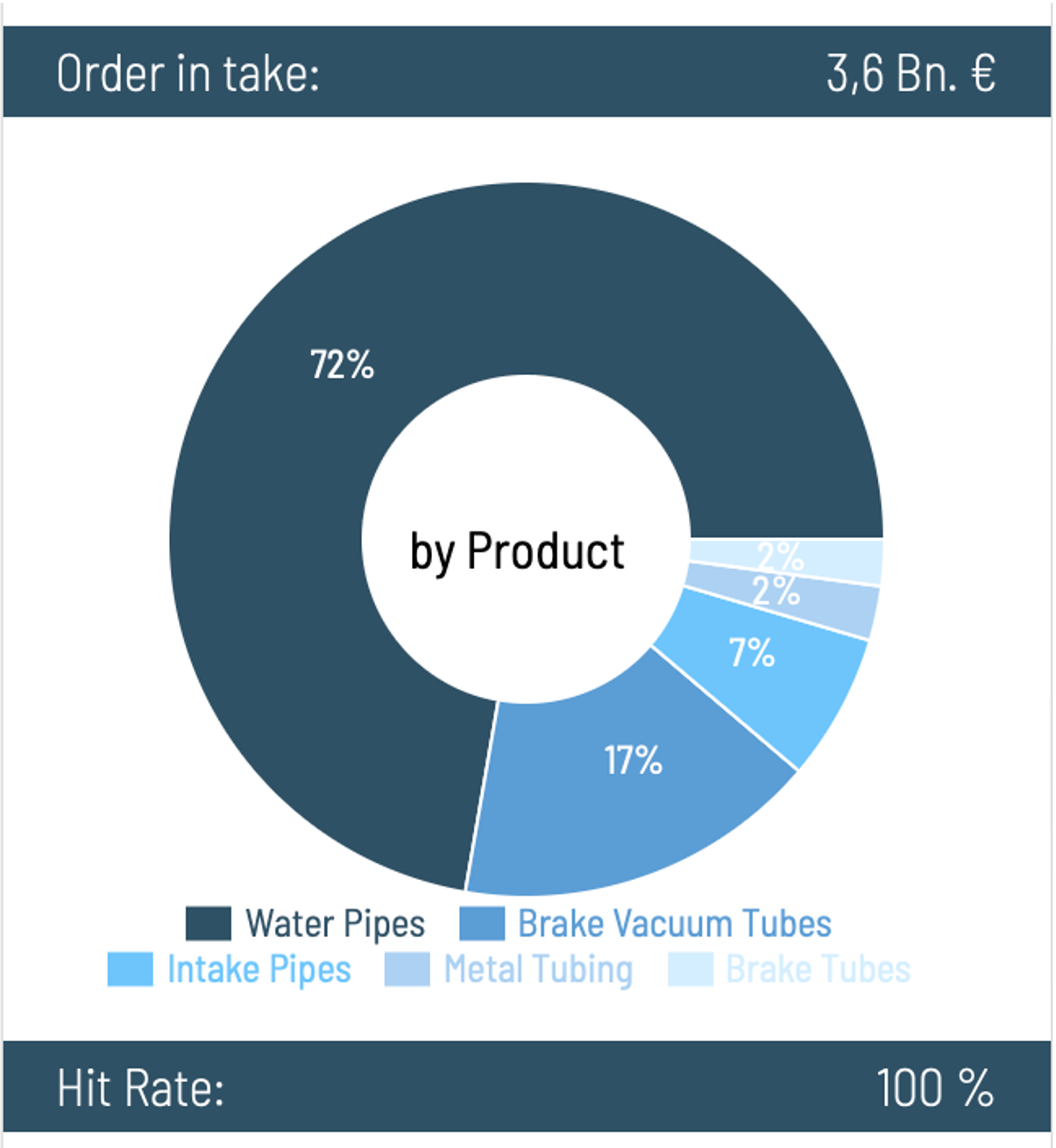

4 SUCCESS CONTROL

Does the order intake correspond to the strategic goals? (hit rate)

CHALLENGE 2

Loss-Making orders

How do loss-making orders happen? And what part does sales play in this? And more importantly, how can sales contribute to make orders profitable?

The causes

There are many causes that lead to loss-making orders. Some of them are homegrown, while others originate in market developments. Here are the main causes:

- Incorrect costing in the acquisition phase

- Overly optimistic assumptions in the acquisition phase

- Lack of profit focus in development phase

- Contract contents do not materialize in series production - especially quantities

- Material prices, energy or labor costs skyrocketing

What can sales do about loss-making orders?

Field of action acquisition phase: transparency

First, it is important to ensure already in the acquisition phase that the risks lying there are identified and avoided. How? Through absolute transparency:

- All RfQ information with a variety of documents and specifications must be accessible to the acquisition project team in the current state. Versioning and the documentation of the latest valid contract status are the requirements here.

- The customer specification to the quantities has to be compared with neutral market data of e.g. S&P Global mobility. On this basis, an internal planning unit number can then be adopted as a basis for calculation. It is also important here to document the customer specification in such a way that it can still be found in 5 years, as this is an essential part of the contract.

- The calculation must be visible and verifiable for experts and decision makers of all departments . Above all with larger orders the substantial assumptions and evaluations are secured ideally with documented 4-eyes principle.

- An essential aspect in the calculation of the business plan are the underlying factors and surcharges. Here, too, it is important to ensure that the correct specifications of controlling are adhered to.

- Decision makers need a standardized decision template in which all essential financial criteria and feasibility assessments are mapped. The word standardized is essential here. Too much time is wasted in management interpreting a wide variety of presentations. A standard provides certainty and the time for essential discussions before decisions are made.

- Plausibility check of prices by comparison with similar projects.

- Binding by (digital) signature.

Field of action Development phase: Profit focus

Most suppliers have the technical part of change management professionally covered in PLM systems. When it comes to project profitability, it comes down to running the commercial part of change management at least as professionally. What does this mean?

- 100% of the customer's technical change requests are to be evaluated commercially.

- Perform the evaluation with the correct factors and surcharges. Anyone who thinks this is the case should feel free to critically check this with themselves in sales.

- Design the offers in such a way that profit is generated from them. And visualize the resulting profit increase with every single change. It must be clear to the sales representative what his offer achieves. Ideally with absolute values, by calculating the price and profit change with the quantities from the date of use to EOP. Fully automated, of course.

- Create a culture of profit increase. How? By making results transparent, comparing projects and rewarding top performance.

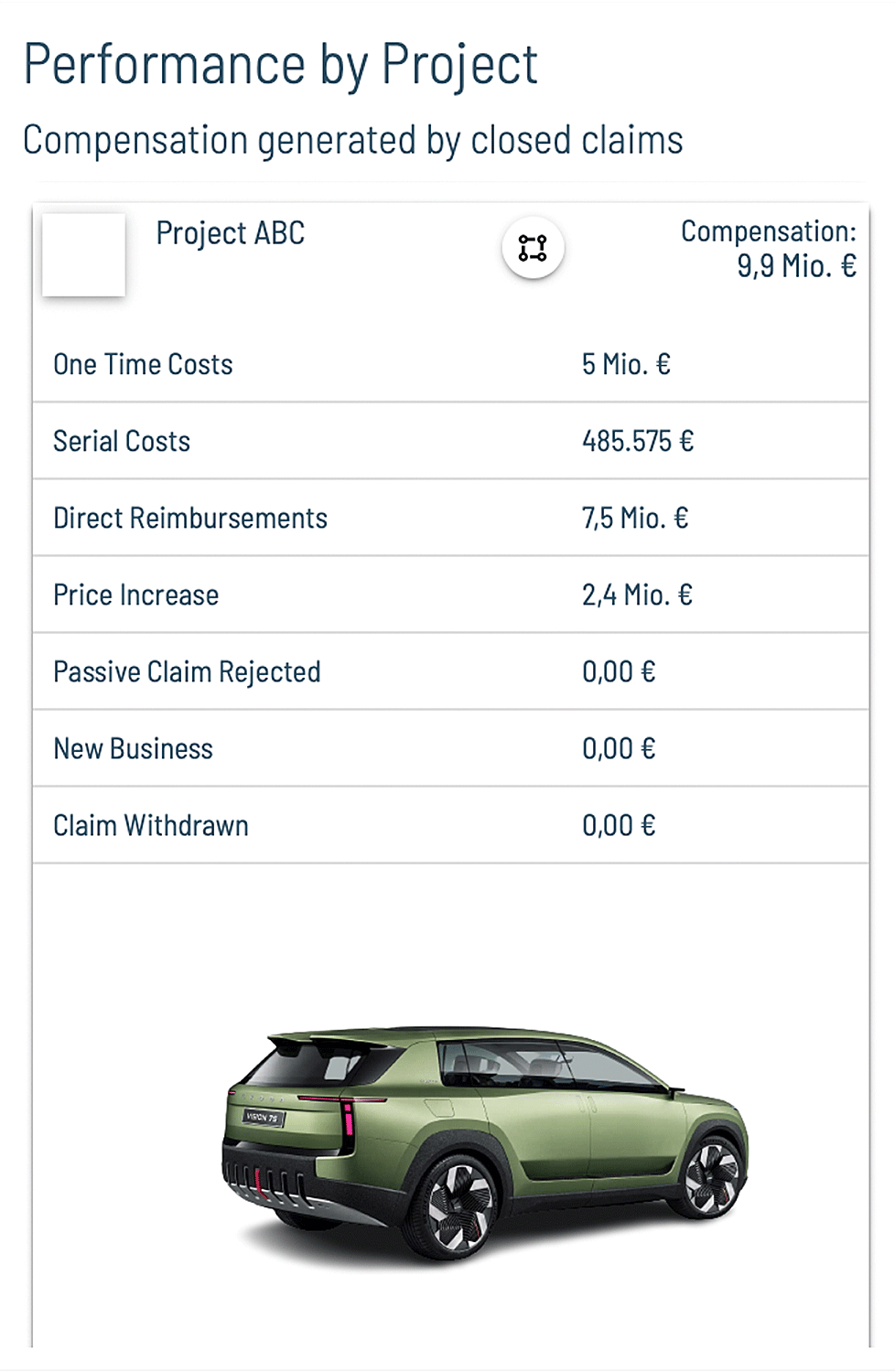

Action field serial phase: compensation for contract deviations

For some suppliers, change management also plays a major role in the series production phase. The above statements also apply here, of course.

In series production, however, another topic also plays an increasingly important role:

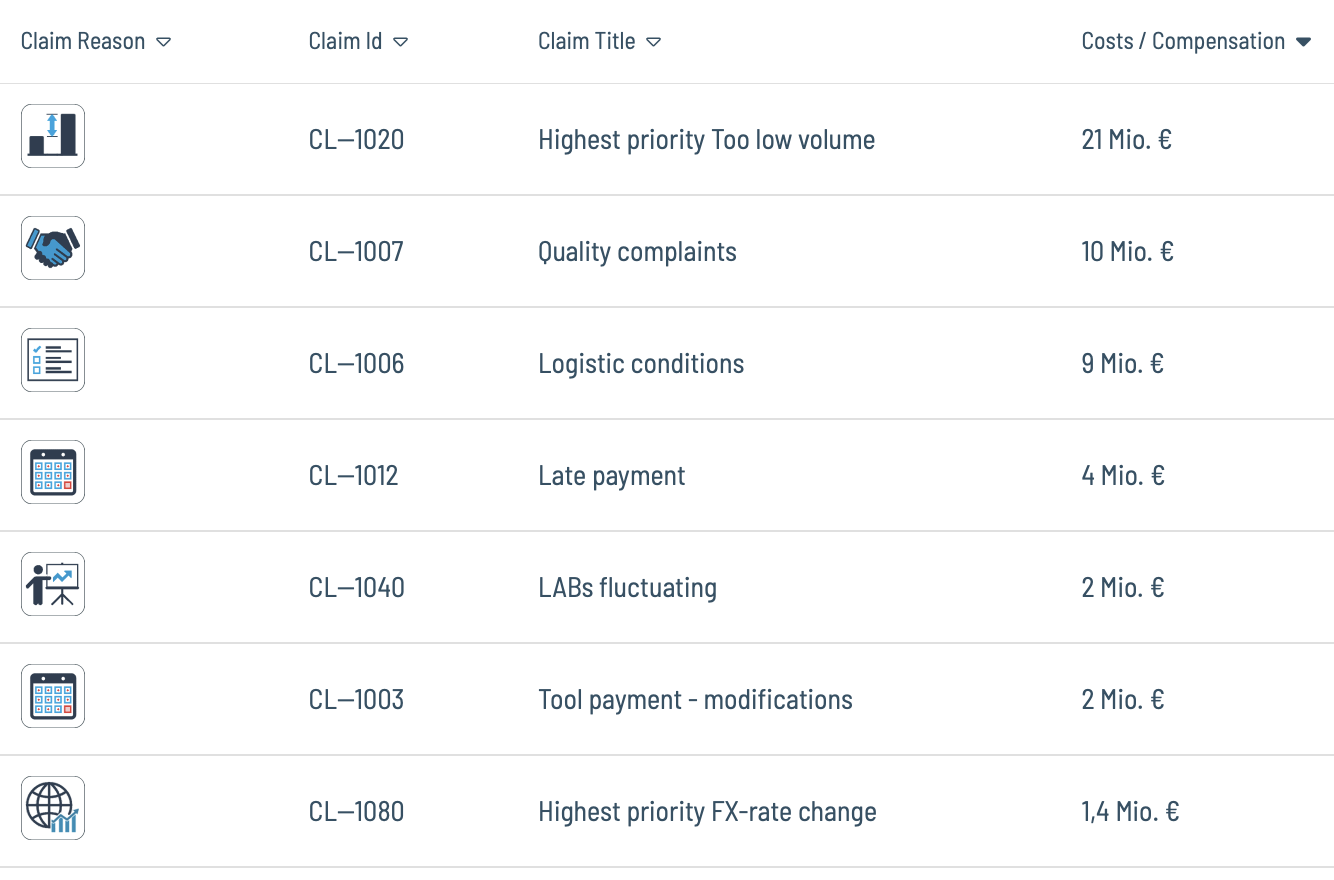

Active claim management. From systematically identifying a claim to following up and receiving payment.

The last few years in particular, with massive quantity variances, skyrocketing material and energy costs, and short-term call-off fluctuations, have put extreme stress on supplier profitability.

The sales department is challenged here to systematically claim every contract deviation. There is a reference to our editorial "Active Claim Management" at the end of this article.

And how can the fields of action be implemented in practice?

Describing ideal processes is not a great art. The challenge is to live them every day, on every project, and by every employee, from acquisition to EOP.

The digitization is the best and probably the only tool that establishes benchmark processes and employees actually work according to them. Digitization helps to create the profit focus and to detect contract deviations in an automated way. And the necessary process and result transparency described above is provided at the same time without any effort.

The possibilities of digitization are briefly illustrated with the following examples:

TRANSPARENCY IN ACQUISITION

From kick-off via evaluation to decision

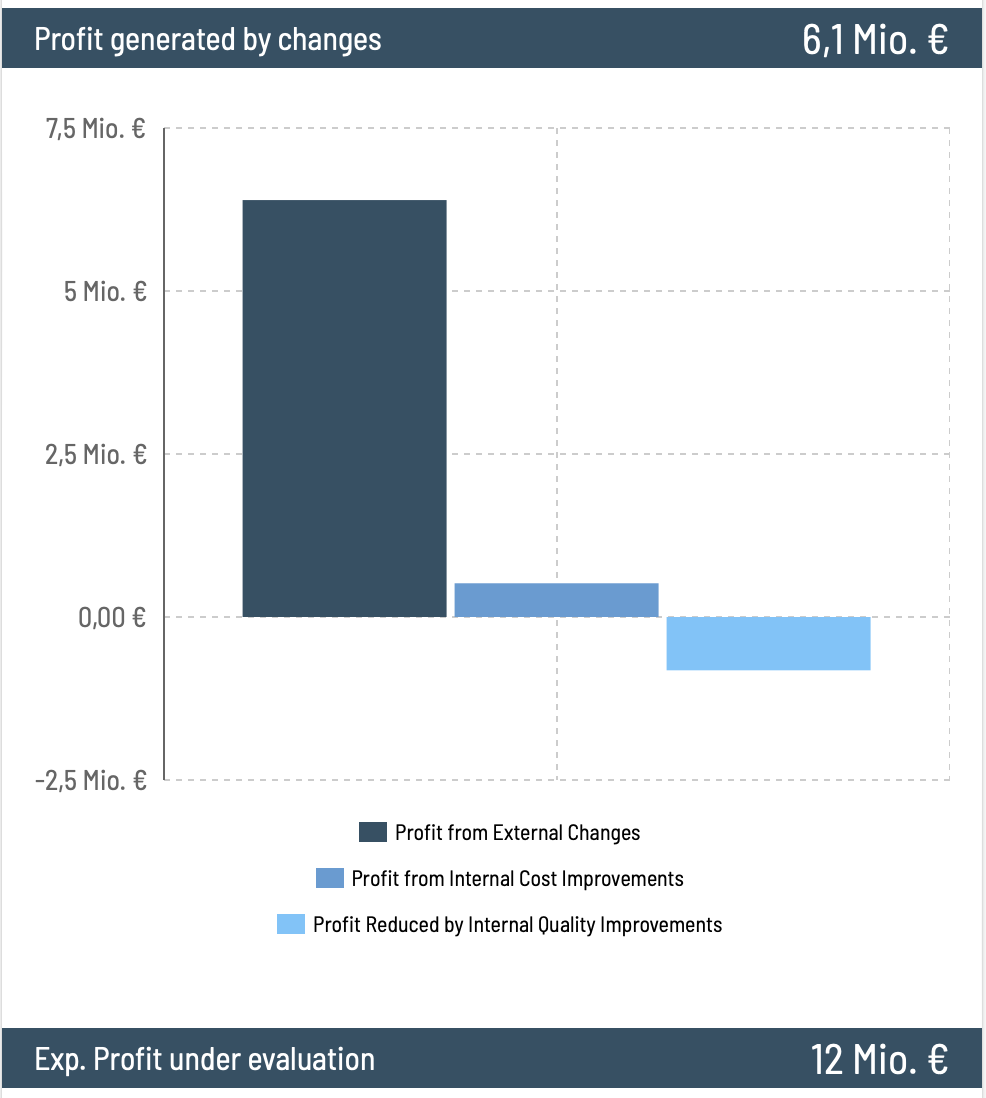

PROFITFOCUS IN CHANGE MANAGENENT

From individual change to aggregation across all projects

ACTIVE CLAIM MANAGEMENT

From automated detection of contract deviations via tracking, to invoicing

CHALLENGE 3

Risk Excel Price Management

Almost every supplier does it. Manage prices in Excel. In the acquisition phase, in change and claim management, as well as in the summary price submissions for customers based on which price orders are created.

The risks are probably aware of the fewest. And this despite the overwhelming importance that prices have for profitability. The most important risks for automotive suppliers are:

Risk 1: Wrong prices

For those who take the trouble to look in detail at how prices and their changes are created, Excel courses for experts can also be booked.

- Transfer errors: Changes, claims and allocations that would lead to higher prices are not transferred or transferred incorrectly. With the large number of part numbers and changes, this is not a reproach to the staff, but to an inappropriate tool.

- Unclarity: The overview naturally suffers due to the multitude of information to be accommodated in price lists. The risk: input errors that lead to incorrect prices.

- Formula errors: The Excel classic arises from a high complexity of links and enormously high amounts of data processed in price lists.

- Forgotten agreements: Price components excluded from life-time reductions (mandated parts, B-prices, etc. ) are often forgotten and mistakenly lead to reductions to the full price.

The worst thing is that the resulting errors rarely become transparent. Incorrect prices are synonymous with too low prices. The customer will certainly point out too high prices to a sales representative. What happens with too low prices everyone can derive from his own experience.

Risk 2: The lack of any control

The complexity and obscurity of these Excel monsters leads to them not being looked at by anyone but the creator. No one takes the time to check these so-called Excel price lists for accuracy. Often a check fails already because of the access and knowledge about the location of these files.

If one considers this with distance, this condition is astonishing, not to say frightening, since prices are the criterion for profits and thus the survival of the enterprise. The eyes are closed with this topic too often after the slogan: "it will hopefully be ok, what people are doing in the price lists."

Risk 3: Highly inefficient processes

This risk is actually not a risk, but a reality. For each topic, there is one separate Excel:

- one for costing

- one for quotes from changes

- one for pricing,

- one for uploading to ERP for billing,

- one for sales planning

- and yet another to measure sales performance

-...

And it's much worse than that: every single one of the above processes means individual, isolated further Excel files with every new change, with every new price submission. An infinite jungle is created, which, if at all, can only be seen through by the creator himself. Not to forget, the process of the price history usually stretches over at least 10 years (!).

Such processes are not only error-prone, but highly inefficient.

This is miles away from target states such as automation, real time planning and real time performance measurement or single source of truth ("one price list"). Not to mention the utopias of working with an AI on this basis.

Risk 4: No integration into the IT architecture

IT managers are right to call for breaking up data silos. The defragmented Excel files do not even represent a data silo, but are a collection of infinite data silos. Linking them to ERP or PLM systems is thus impossible.

Risk 5: Security

Only the person processing the Excel price lists knows how the links and formulas work. If that employee leaves or fails, colleagues face nearly impossible tasks.

Excel is also usually synonymous with locally stored files. For such sensitive data, a high data loss risk that many suppliers take here (unknowingly).

How to get out of the Excel world?

It won't come as a big surprise, but the answer here is also digitization. An overall system in a proper software, with which all prices are professionally managed from acquisition to EOP (a lifetime span of 10 years) with all change influences, eliminates the risks pointed out.

Digitization helps, gain transparency and control over prices. Prices must be available at all times, and not just those prices that are in the ERP for serial billing. By then it is already too late. The crucial part in price management takes place before the entry into the ERP system.

Digitization enables automation. If there is one field where automation makes extreme sense, it is in price management. To generate efficiency gains, but much more so to avoid errors. Because these cost the automotive supplier real money.

The following summary chart illustrates the influences from acquisition, change and claim on prices including their detailed information with break-downs, allocations, LTA's etc. The positive effects of an overall system are shown on the right side.

CHALLENGE 4

No Time

Nobody has time. Especially not in sales. Why actually?

From conversations with countless sales colleagues from automotive suppliers, 3 things stand out:

The risks are probably aware of the fewest. And this despite the overwhelming importance that prices have for profitability. The most important risks for automotive suppliers are:

1. Time-eaters Ad hoc Reporting

In sales this is worse than in any other area, for 2 reasons:

- In sales, there is extremely interesting and important information for the success of the company

- There is usually only very rudimentary standard reporting in sales available

The worst thing is that the resulting errors rarely become transparent. Incorrect prices are synonymous with too low prices. The customer will certainly point out too high prices to a sales representative. What happens with too low prices everyone can derive from his own experience.

The time spent on ad-hoc reporting is due to:

- Searching data

- Analyze data

- Create report

-

Correct report if management prefers a different presentation

The tasks and questions are repetitive - here is an excerpt:

-

How many electric cars will be built in Europe next year?

-

How much revenue will we make from customer xy in 5 years?

-

What does our product portfolio look like?

-

What projects do we have planned with the new future product xy?

-

Will plant xy be at capacity in 3 years with the planned orders?

-

What order intake have we achieved in the last 12 months?

-

What orders are we currently competing for?

-

What SOP´s do we have in the next 12 months?

-

How much damage have we incurred from volumes that have not come?

-

How much are the open claims at customer xy?

-

What did we get out of project xy with change management?

-

How many open changes do we actually have?

-

What is the incoming payment in the next 6 months through tooling invoices?

-

How many quicksavings do we actually have to give?

-

...

All these issues can be mapped in an automated standard reporting by using the data available from the processes that are anyway done. The goal of digitization must be to eliminate 80% of ad hoc reports. With software tailored for automotive suppliers, this is possible. And for the remaining 20%, even the data and file search is significantly reduced.

2. No time: too little focus and orientation

A clear direction (strategy) where to put energy is missed in many places. It is about focus on the issues that bring a lot. Prioritize the processes that occupy sales people most of the time: Acquisition, change, claim and order management. How?

What is needed for this are anytime available and up-to-date overviews that visualize priorities easily. In claims, the amount of the claim certainly determines the effort to be made. In order management, the amount of transactions to be billed. In the acquisition the strategic priority.

It's about putting time into the things that really matter.

3. No time: software like in the 90s

In the sales department of most automotive suppliers, software is used as it was in the 90s. Process optimization does not take place. This is not meant to sound ironic, but is simply the case. Excel + PowerPoint already existed back then. A high-tech industry such as the automotive supplier misses it in the administrative processes to modernize just as it does with their products and production processes.

The consequences of non-digitization

- No way to automate processes

- data is entered x number of times

- Reports are created manually every time (see above)

That the employees then have no time is not surprising.

And the situation will get worse due to the skilled worker shortage. If you are not modern as an employer, you will not be attractive to young employees. The consequence: the remaining colleagues will have even less time.

What is the solution?

Time is gained through automation in all sales processes. Pre-filled input fields, one-time data entry and fully automated management reports.

In honor of the automotive suppliers, it should be said, the range of meaningful software alternatives to Excel and PowerPoint was also not given until now. From classic CRM software, most have refrained from the outset or recognized that this is not the solution.

What the automotive supplier sales needs is a tailored software solution that covers exactly their processes in depth and makes the processes more efficient and faster. This creates time for the essential things. Digital Automotive is the leading automotive supplier sales software standard.

To illustrate, here is an example of how flexible management reporting can be for automotive supplier revenue curves. Ad-hoc reports to present the sales curves should be a thing of the past. And best of all: the data is also displayed in real time:

CHALLENGE 5

Making Successes Visible

Whoever wants to have a performance organization - and some even wish for a high-performance organization - must make successes transparent. High performers and success projects must be recognized and rewarded for this purpose.

Why actually?

1. Bringing goals to life: Corporate, divisional or individual goals should not be something abstract that you make once a year and then file away. If you want to achieve your goals, you have to have them present and make the results and successes visible.

2. Retention of top performers: In a culture where effort is seen and rewarded, people will make an effort and perform for the company. If this is not the case, top performers will seek out an environment where it is.

3. Motivation: Ideally, the example of the top performers also inspires all employees to top performance.

4. Improvements: By making performance visible, potential for improvement can also be identified. If a department or employee is consistently underperforming, it may be an indication that improvements are needed.

The Goal: Real-time performance measurement

all processes of automotive supplier sales can generate reports completely automated. Without additional effort - but with real benefit.

The reports represent thereby not only business developments, but also the performances in the acquisition, claim and change management.

If these results are linked to the annual target agreement, this results in a real-time target review, where all parties involved know at any time where they stand. Deviations are detected in time and it can be steered intervened.

Real-time performance measurement is an important tool for continuously improving the performance of automotive supplier sales units, increasing their effectiveness and achieving competitive advantages.

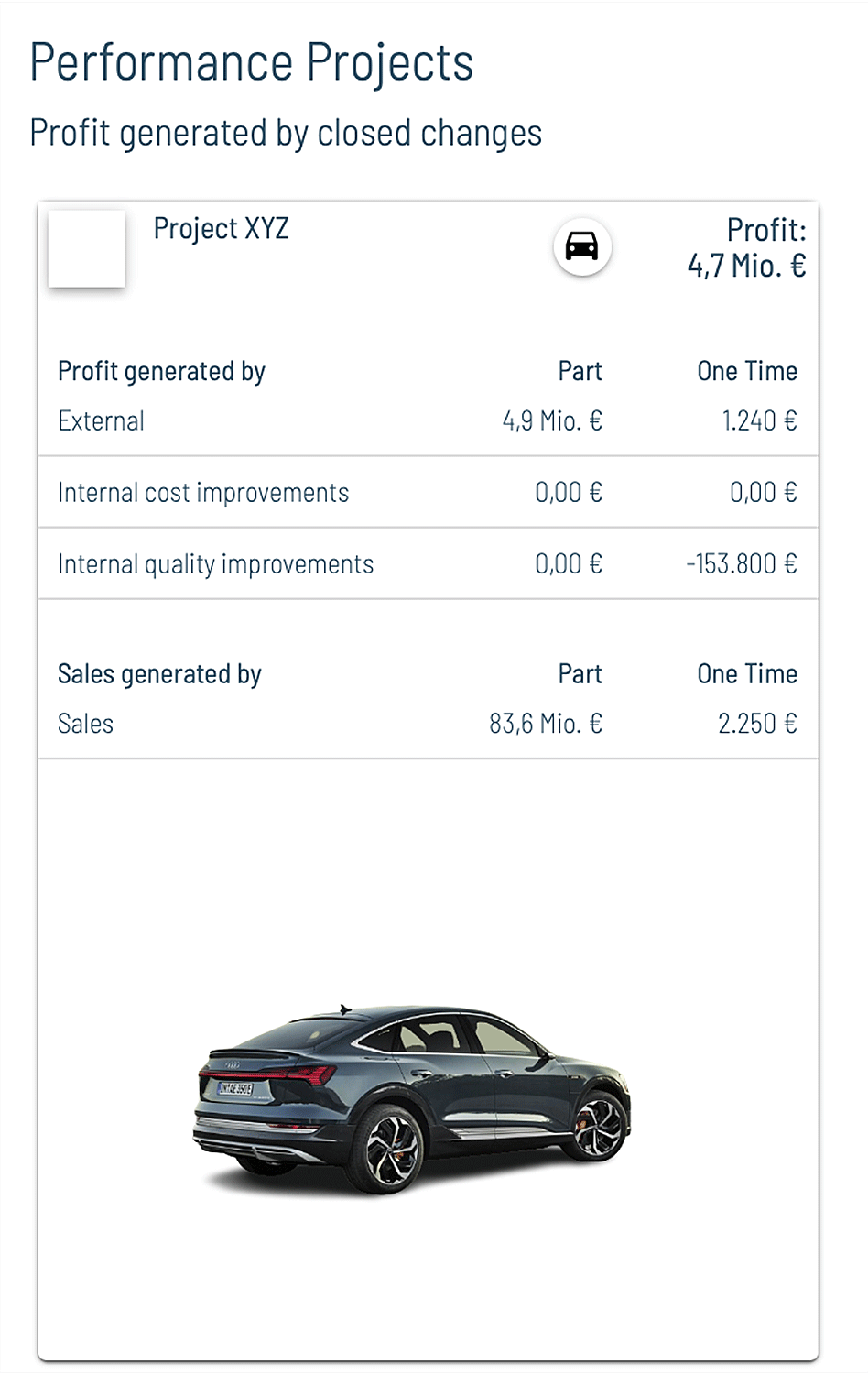

Here are 3 examples of what performance measurement can look like:

COMPENSATION THROUGH ACTIVE CLAIM MANAGEMENT

The results achieved in Claim Management are immediately available at every level of aggregation. With real-time updates whether at project level, for specific customers or regions.

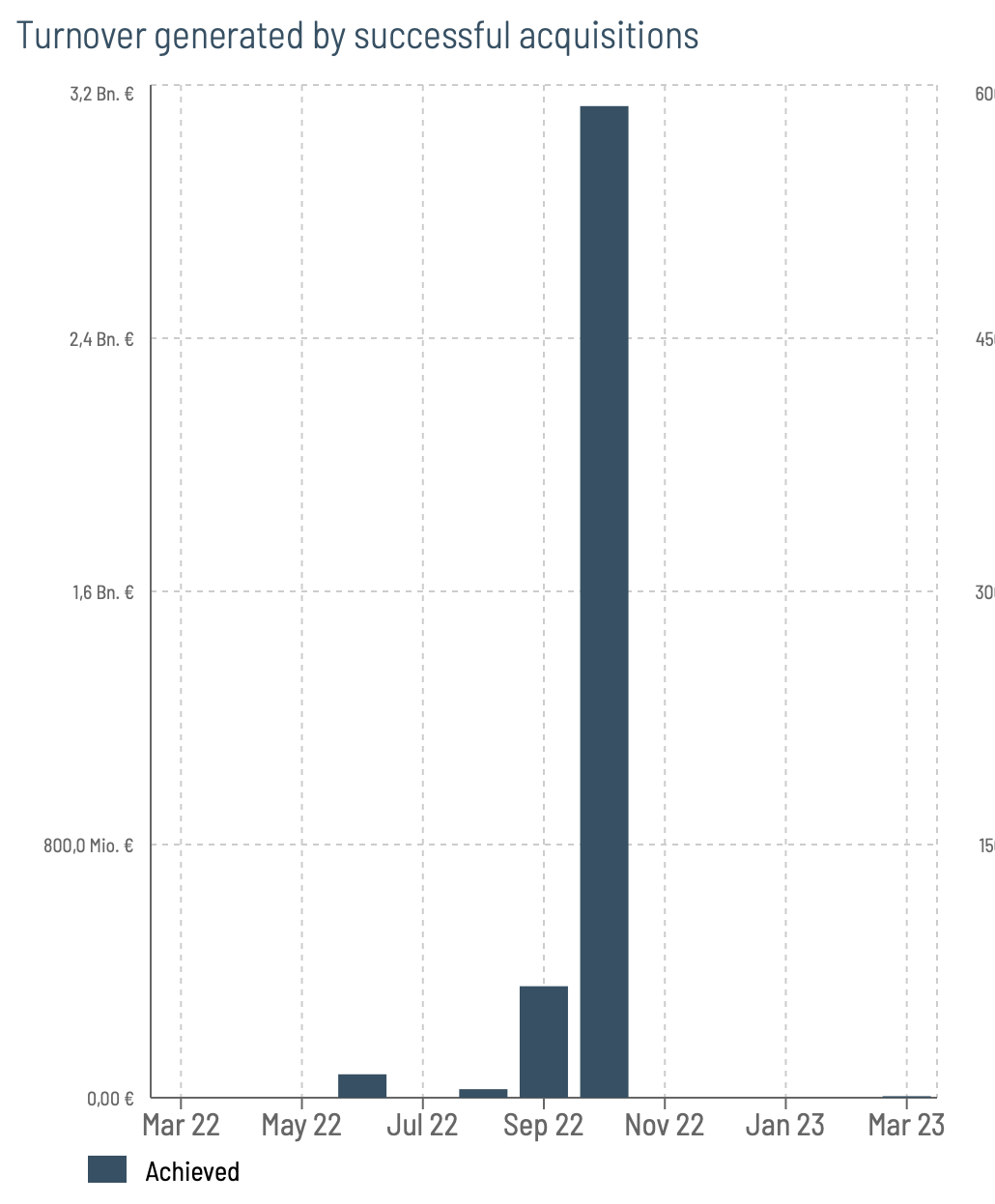

NEW BUSINESS WON

In which month which incoming orders were achieved. Available at any time and created automatically.

SUCCESSES IN CHANGE MANAGEMENT

For each project, the achieved results become visible. And this applies to technical customer changes as well as to internal product or process optimizations.

THE SOLUTION TO THE 5 CHALLENGES:

Digitalization with a solution specifically for Automotive Supplier Sales

Digital Automotive developed by automotive suppliers and take a big step towards sales professionalization.

It's not about digitization for digitization's sake, it's about creating real value and a solution to the key challenges facing the world's sales departments.

The added value comes from benchmark processes for all sales-related processes. Automated management reports that provide transparency, enabling right decisions and putting performance first.

Experience the Next RFQs and SOPs Powered by Digital Automotive?

In over 25 years of automotive supplier sales management, we have learned the benefits of digitization. Discover an improved process experience with Digital Automotive. We are happy to share our expert knowledge with you.