S&P Global Mobility Data in Digital Automotive

IN FOCUS

S&P Global Mobility in Digital Automotive

How do automotive suppliers benefit?

- Resources

- Publications

- S&P Mobility Data in DA

Executive Summary

S&P Global Mobility data (formerly IHS) combined with the Digital Automotive processes and reports lead to better decisions, more successful negotiations and significantly less manual data entry and preparation. A gain in efficiency, transparency and quality.

How? By having the right information, at the right place, at the right time, in the right format, and by processing it automatically wherever possible:

1. Automated market analysis reports: designed according to the expectations of automotive supplier management. The S&P Global Mobility production data and forecasts are processed in Digital Automotive into market development, location strategy or market share reports - with absolutely no effort and easily accessible at any time.

2. Sales planning as easy as never before: from the basic market strategy, to the inspiration of specific target vehicles or engines, to the use of S&P Global Mobility data for volume forecasts and project data such as SOP/ EOP or production locations. Less data entry, more transparency in automated sales reports with filters for customers, products, regions, locations and volume scenarios. All in real time.

3. Assess volume risk in acquisition: Make better decisions by comparing the customer request volume with the "neutral" S&P Global Mobility volume in the Digital Automotive acquisition decision report.

4. Strong argumentation in the claim negotiation: if the customer purchasing department argues for too optimistic volume forecasts, S&P Global Mobility provides the decisive volume information at the right place in the Digital Automotive claim process.

5. Conclusion: Automotive suppliers benefit from the strategic partnership of S&P Global Mobility and Digital Automotive through more transparency, efficiency and effectiveness.

INTRO

Why S&P Global Mobility Data in Digital Automotive?

More transparency, efficiency and effectiveness for automotive suppliers

The right information

S&P Global Mobility data (formerly IHS) includes all the vehicles and engines from every manufacturer in the world in one summary. Awesome.

And these vehicles and engines are not only listed according to a structured standard, but have volume forecasts for the next few years at the center. In addition, there is data on SOP's and EOP's, on production locations and many other details that automotive suppliers in top management, marketing and sales need for planning and steering their daily work. Used correctly, the data becomes valuable information.

The right information is the basis for the right decisions, planning and control. On the one hand, right means that the information must be correct, which is ensured by a trustworthy source such as S&P Global Mobility. On the other hand, the information must also be necessary to improve decisions or make work more efficient in the respective context. The right information should therefore not (as is unfortunately often seen in practice today) be presented somehow, somewhere and sometime, but...

...at the right time, at the right place, in the right format

The challenge is to make the organization aware that this relevant information exists. The easiest way to do this is to have it in the right place in the sales processes and in the steering & planning reports.

In Digital Automotive, S&P Global Mobility data is deeply integrated. Always with the aim of presenting the data in a way that is suitable for management. Find out how you can benefit from this as an automotive supplier...

"Suppliers benefit from the strategic partnership of S&P Global Mobility and Digital Automotive."

Erik Reiter

25 years Automotive Supplier-Management (Sales -> CEO); Sales Consultant for Strategy and Processes; Co-Founder Digital Automotive

BENEFIT 1

Automated Market Analysis Reports

Today, S&P Global Mobility data is used by most automotive suppliers in the form of Excel tables. To turn this into readable information, it is usually prepared manually using complex pivot tables or power bi tools. But this does not have to be the case:

In Digital Automotive, these reports are available automatically and always with the latest S&P Global Mobility data status. Simply available, without manual creation effort.

Reports made for the management of automotive suppliers

The automatically generated reports are a best-of-automotive with the collected knowledge that managers of automotive suppliers want to see in order to understand the market development and draw the right conclusions.

Market development, footprint strategy or market share reports provide valuable insights in Digital Automotive for the strategic alignment of the automotive supplier.

Anytime, anywhere and easily available

An important aspect that we notice again and again: The valuable S&P Global Mobility data is lying dormant somewhere in the marketing department or with data analysts and is therefore only used sporadically.

In Digital Automotive, this data is integrated into the workflows of the employees and into the reports for the managers. Extremely easy to use and available at any time. The result: data that is permanently used and thus becomes valuable information.

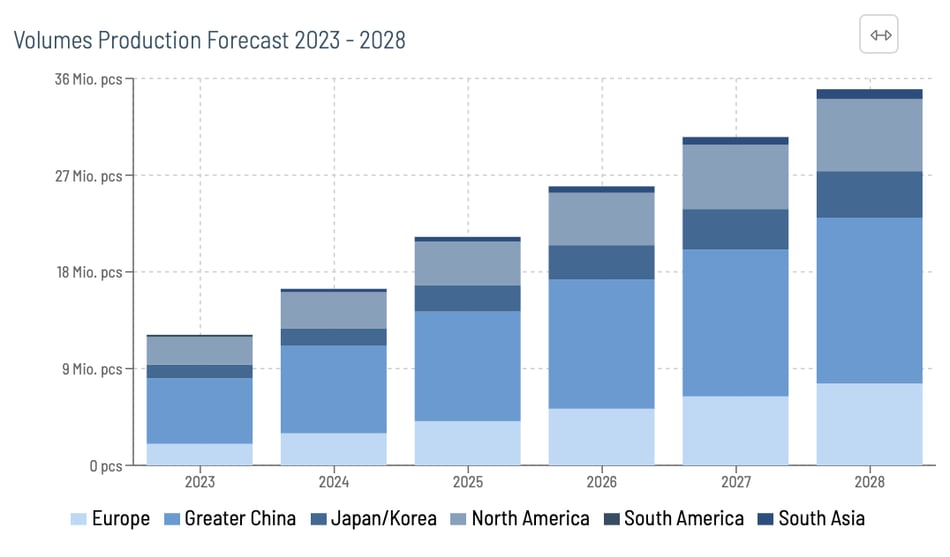

Example 1: market volume analysis:

Available with one click: The development of electric cars worldwide. If you want to have the display only for a specific OEM or a specific region: no problem - here, too, just 2 more clicks

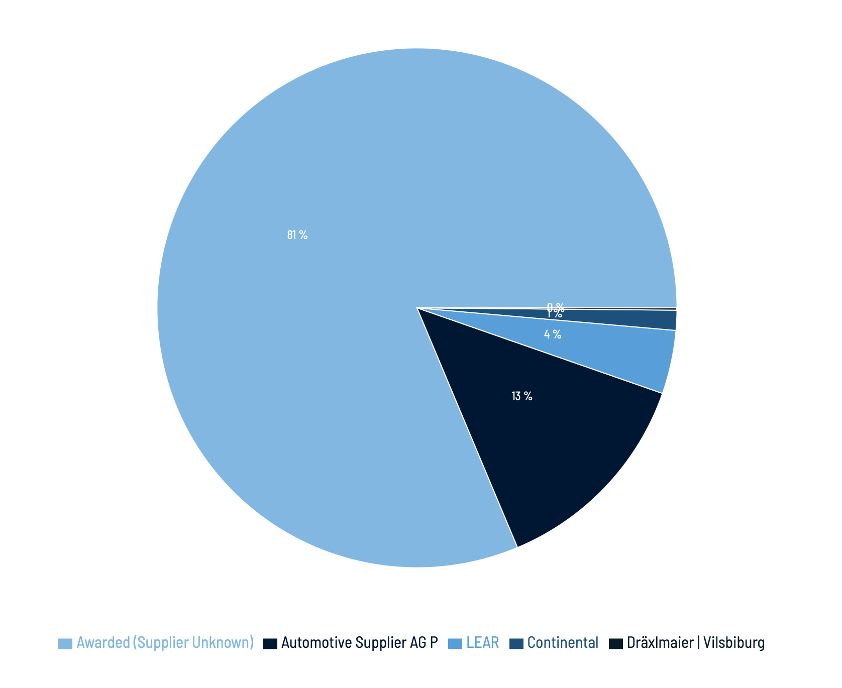

Example 2: market share calculation:

One of the most powerful features in Digital Automotive is the automatic market share calculation. By leveraging booked and strategic projects within the platform, combined with S&P Global Mobility data, market shares are calculated fully automatically. This offers a significant time-saving advantage, allowing you to view market shares by product, region, or customer. With the right data, you can even factor in competitor data.

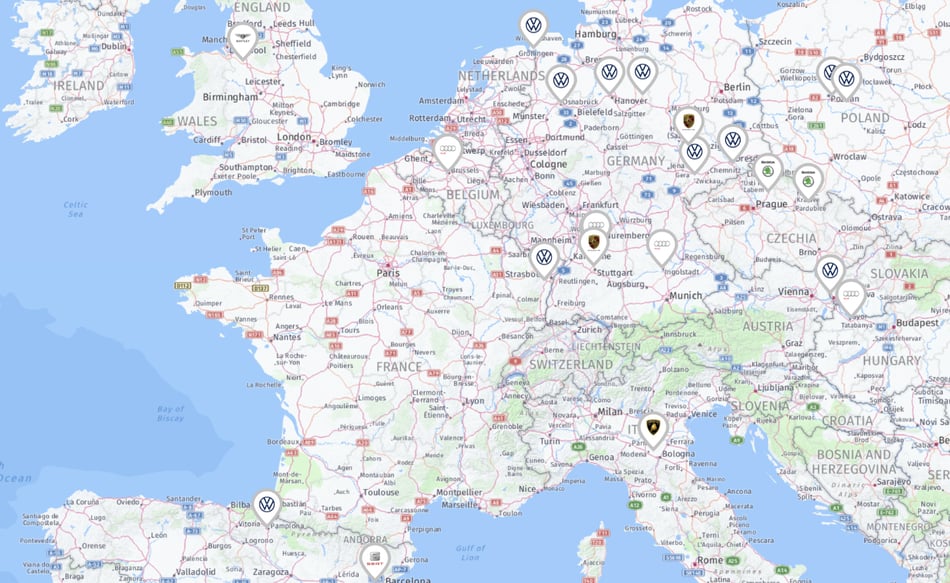

Example 3: footprint analysis:

the locations of the VW Group on the map of Europe: own locations that can be faded in and drill-downs allow further insights into produced volumes at the respective location:

BENEFIT 2

Sales Planning easier than ever before

Deep integration of S&P Global Mobility data into Digital Automotive means leveraging data throughout the sales planning process for:

-

Alignment of the market strategy

-

Inspiration to specific target vehicles or target engines,

-

Use of project data such as program codes (standardization!), SOP/ EOP's or production locations

-

Use of volume forecasts in planning and analysis

Less manual data entry during project creation, more transparency in the automatically generated sales reports with filters for customers, products, regions, locations and volume scenarios. And all this in real time.

(1) S&P data as inspiration for target vehicle and target engine selection

Leverage the power of full S&P Global Mobility overviews on potential target vehicles and engines: Digital Automotive is designed to easily identify the ideal target projects.

With filters that are intuitive to use, it is easy to identify cars and engines that should include your own products in the future: With the right customers, in the right regions, the right segment and the appropriate volumes at the ideal SOP time. The result: an operationalized market strategy based on maximum transparency!

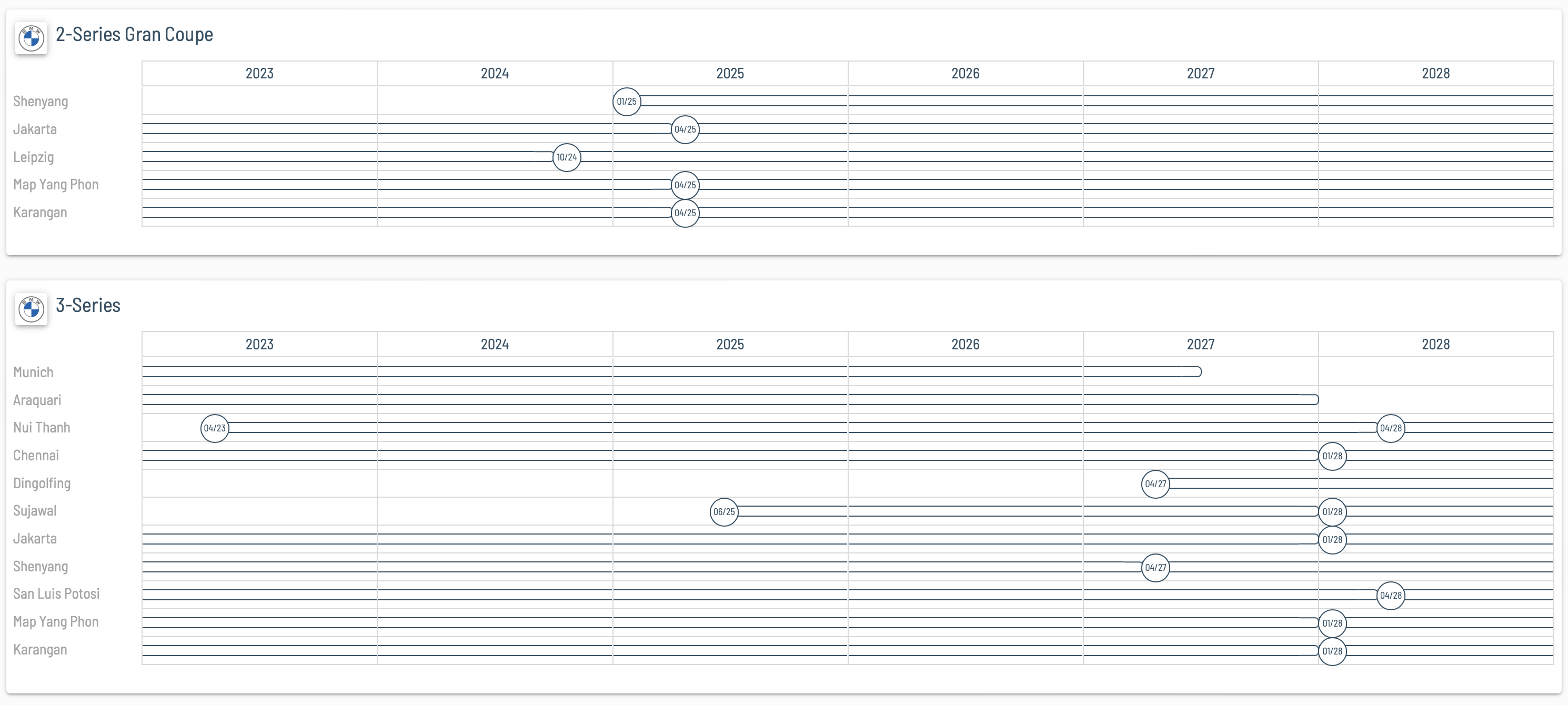

Example model cycles: The SOP's of the 2-series and 3-series BMW in the next years at all worldwide locations. The search can be customized in Digital Automotive according to any criteria (OEM, Region, Plant etc.).

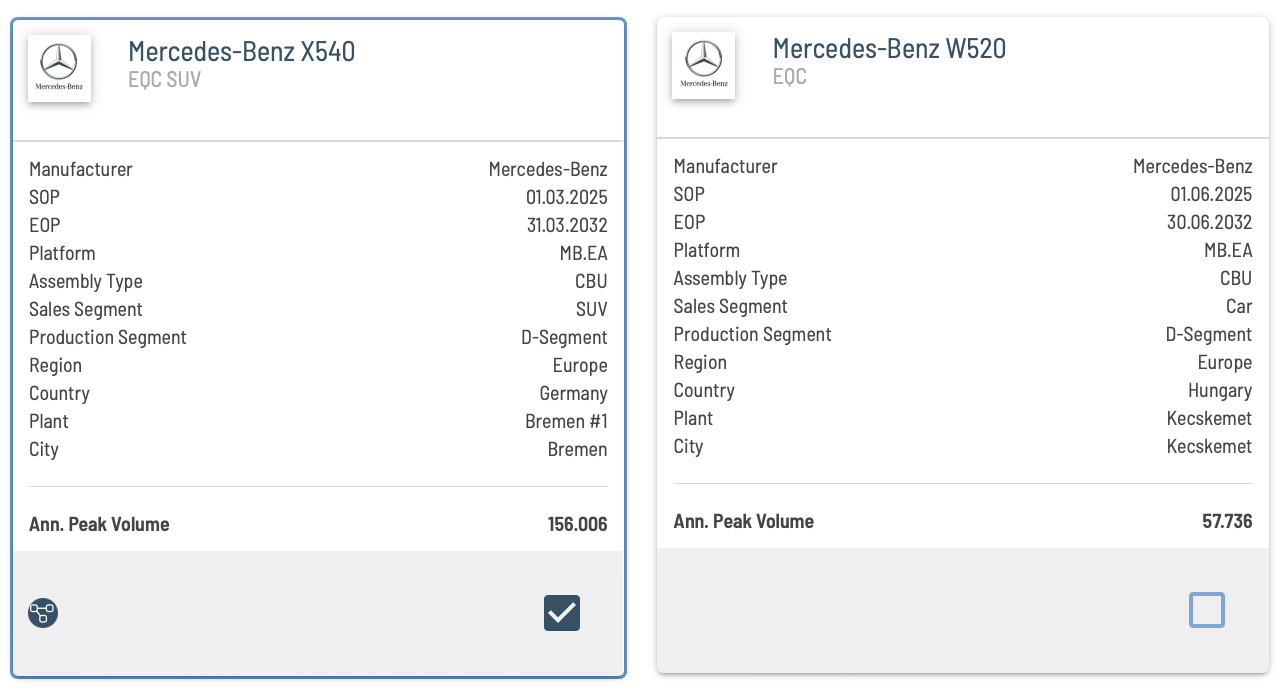

(2) Easy project creation in less than 30 seconds

Creating a new strategic project has never been easier. The project creation uses the existing S&P Global Mobility data and automatically pre-fills the necessary input fields. With just a few clicks and practically no data entry, a new strategic project is created with all relevant elements.

A major advantage is that the project name is created in a standardized way. Today, we see unstructured project names at many suppliers, which limit readability and evaluation options. Project name standardization also creates the necessary basis for future AI applications.

Example project creation: Simply select the target vehicle with one click from the cards created in Digital Automotive based on S&P Global Mobility data:

The link to the S&P Global Mobility data enables pre-filling with all basic data from the program code to the delivery location to the SOP data. And the volumes for the sales forecast are of course pre-filled as well. Without manual effort.

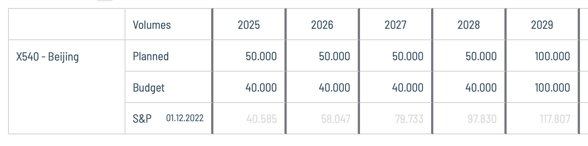

(3) Sales forecasts as easy as you need them to be

The S&P Global Mobility volumes are available directly with the project creation for the sales planning. You want to plan with other volumes? No problem, in Digital Automotive there are separate lines for your scenarios or budget planning. The S&P Global Mobility volumes can thus serve as a "single source of truth" or to verify your own/customer assumptions.

Example of volume planning: The S&P Global Mobility volumes are automatically taken over. If you want to display your own plan or budget scenarios, these can also be easily stored.

All you need now are the prices for your products. You decide whether you want to plan "high-level" with a price on average vehicle level or on part number level and with price components defined by you.

Example prices "High-Level" planning: The price entry is simple and with all the comfort you know from Excel. And if you want to plan in detail: In Digital Automotive, this is also possible in an uncomplicated and flexible way.

(4) Automatically update your projects with each volume update

When the S&P Global Mobility data is updated, the S&P volumes of your projects are automatically updated and thus the revenue forecast in Digital Automotive. A gain in efficiency and transparency.

For the special topic "broken link", which is particularly relevant in the engine sector, there are great solution possibilities in which the combined automotive expertise of S&P Global Mobility and Digital Automotive is used.

(5) Sales planning with different scenarios and in all dimensions

Digital Automotive enables the comparison of sales on the basis of different volume scenarios. In this way, the S&P Global Mobility Forecasts can be compared with the company's own planning assumptions. This tool becomes really valuable when all data is continuously updated. This results in real-time planning, in which the most up-to-date sales forecast is available at all times. The last few years in particular have shown the necessity of continuously updated sales forecasts. Only in this way can decisions be made quickly on the basis of transparent data.

In Digital Automotive, sales revenues can not only be displayed at the project level, but can of course be aggregated and visualized in all dimensions. Evaluations according to customers, regions, products and locations are fully automated. Based on S&P Global Mobility data or your own scenario.

Example sales presentations: Easy filtering by any dimensions and scenarios.

BENEFIT 3:

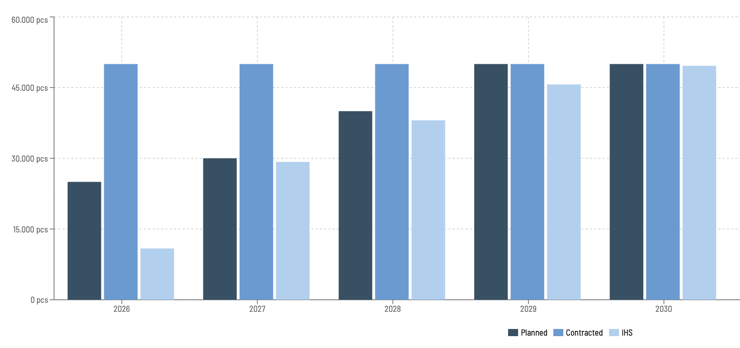

Assessing the Volume Risk in Acquisition

The big issue in the relationship between OEMs and automotive suppliers is the volume basis on which calculations are made and prices are agreed. Even before Corona, the semiconductor crisis and the Ukraine war, the volumes specified by the OEM in the RfQ phase only actually materialized in a minority of cases. The few positive (OEM) exceptions confirm the rule.

The impact of volumes on profitability can be easily shown with a simple rule of three: Assuming a contribution margin of 30% (which many suppliers have) and a volume deviation of 20% (which affects the absolute majority of orders), 6% points of margin are lost. For most automotive suppliers, this magnitude already determines profit or loss.

The range of variation and the enormous impact on profitability and cash flow show that it is absolutely necessary to compare the requested volumes with a neutral source. S&P Global Mobility provides the data for this. Digital Automotive brings this information to the right place - the decision document for the acquisition decision - and at the right time - when the offer is signed. This gives decision makers the ability to properly assess the volumes risks before signing. Only this transparency creates a real basis for decision-making.

Example of making volume risk transparent: Easy comparison of the "neutral" S&P Global Mobility data (IHS) with those of the customer inquiry ("contracted") and the company's own planning assumption:

BENEFIT 4:

Strong Argumentation in the Claim negotiation

Claim management has become a standard process in the automotive industry in recent years. Digital Automotive delivers complete transparency, efficiency and effectiveness, from automated detection of contract deviation to a guided process and settlement.

Every process step in active claim management is critical to success. This naturally also applies to the claim negotiation step. The classic reflex of the customer buyer to a demanded compensation for a volume deviation in the past is: "Let's wait and see, the volumes will all be made up next year." This is exactly the point where a "neutral" argumentation support is needed with which the salesperson can counter.

S&P Global Mobility is that "neutral" source. The data is a recognized source of volume information throughout the industry. Every automotive supplier should use it in the claim negotiation if the outcome of the negotiation also depends on future development. Digital Automotive delivers this information directly in the claim workflow. Just at the right time, when the sales representative needs to know how vehicle volumes will develop in the future.

CONCLUSION

A strong Combination for every Automotive Supplier

The strategic partnership between S&P Global Mobility and Digital Automotive is a powerful combination for every automotive supplier. In the different project phases of strategy, acquisition, development and series production, automotive suppliers benefit from end-to-end processes. The deep integration of data in Digital Automotive reduces the manual workload and increases transparency for decision-making.

Those who want to work professionally in the core sales processes, from strategic planning to acquisition to claim management, get exactly what they need to grow profitably: the right information, at the right time, in the right place, in the right presentation.

Experience the Next RFQs and SOPs Powered by Digital Automotive?

In over 25 years of automotive supplier sales management, we have learned the benefits of digitization. Discover an improved process experience with Digital Automotive. We are happy to share our expert knowledge with you.